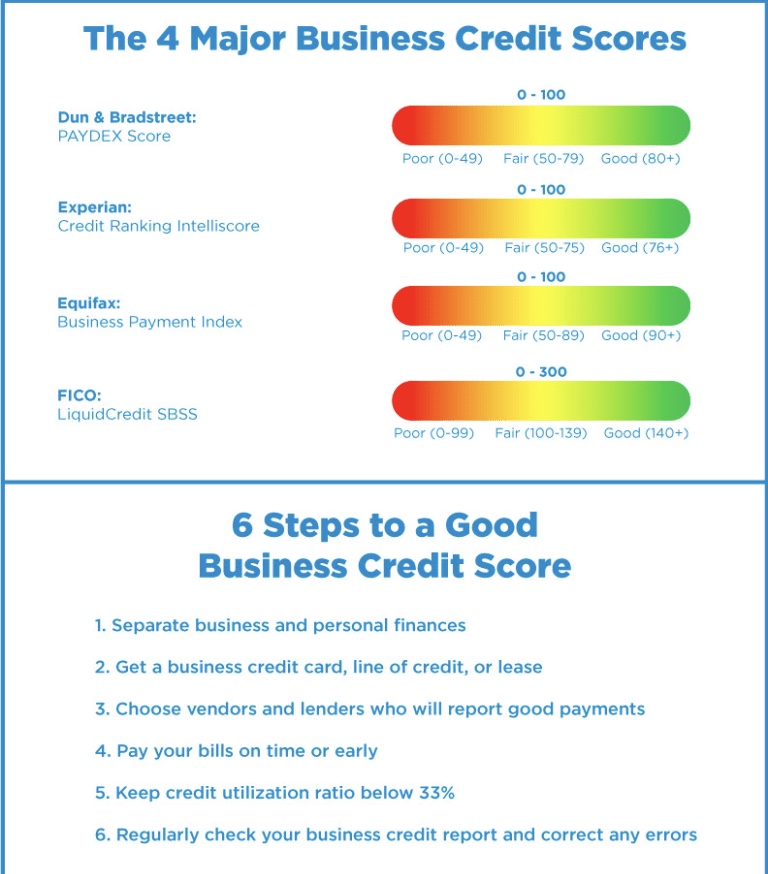

This is a 12-month program designed to position your business for major bank financing by building your company's credit profile and score with the 4 major business credit bureaus; Duns & Bradstreet (PAYDEX), Experian Business (Intelliscore Plus), Equifax Business (Business Payment Index) ,Fico Business LiquidCredit score (SBSS)

Credit health impacts businesses every day; In the same manner that your personal scores serve as financial ratings for your as an individual, your business credit scores rank the creditworthiness of your business. Lenders and creditors need to determine how well your business repays debts before they will approve you for traditional business bank financing.

Good business credit strengthens bank relationships; higher scores tell lenders that your business is trustworthy, thereby improving your odds of successful funding. Lenders can also check your company’s business credit reports to get more detailed information about your business’s financial history, and the business credit scores serve as shorthand evaluations.

These scores a key to getting approved for financing and trade credit, as well as qualifying for lower rates on things like business insurance and certain loan options. Anyone can check your business credit rating, so it’s in your best interest to know what’s contained in your business credit report.

Scope of Work:

Establish Business Tradeline Foundation & Corporate Funding Readiness

- 12 months hands-on coaching with a Corporate Credit Professional who can answer your questions and provide real solutions

- Evaluate existing business credit profiles and provide strategies that increase the likelihood of credit approvals

- Ensure your company meets business credit compliance standards

- Establish your company’s profile with Dun & Bradstreet

- Build your company’s D & B Paydex to 80

- D & B profile cleanup, remove derogatory comments from file (if necessary)

- Establish your company’s profile with Experian Business

- Build your company’s Intelliscore to 80

- Experian profile cleanup, remove derogatory comments from file (if necessary)

- Provide known transaction-reporting vendors and exclusive Trade Exchange vendors

- Open various Net 30 and revolving credit accounts to establish tradeline history

Corporate Credit Compliance Evaluation

- Research your company from the lenders perspective

- Provide solutions for missing compliance items

- Verify corporate status with your secretary of state

- Set up files with D & B and Experian

- Get Paydex and Intelliscore populated

- Evaluate Key Scoring Factors that affect your company’s ability to obtain credit

- Dispute derogatory information in your company’s credit reports (if necessary)

- Ensure the consistency of your company’s data across multiple credit reporting bureaus

Net 30 Vendor Credit Accounts

- Open 5 - 10 Net 30 No-PG vendor credit accounts

- Unlimited credit in vendor credit accounts

- Establish and evaluate reporting

Retail Business Credit Accounts

- Open 5 - 10 revolving retail credit accounts

- $25K - $50K in No-PG revolving retail credit accounts

- Establish and evaluate reporting

PG & No-PG Business Credit Cards

- Open 3 - 5 PG & No-PG Business Credit Cards

- $25K - $50k in revolving business credit card accounts

- Establish and evaluate reporting

$15,000 ‘Authorized User’ Small Business Loan

- Liquid FICO Builder - No access to funds, reports to Experian Business & SBFE

- This is a real small business loan guaranteed to report on-time, ongoing payments through the maturity of the loan, and it will remain on the report as a positive account after the loan is closed

- This small business loan is designed to enhance the depth and strength of your business credit profile with Experian and the Small Business Finance Exchange (SBFE)

$25,000 ‘Authorized User’ Small Business Loan

- Liquid FICO Builder - No access to funds, reports to Equifax Business & SBFE

- This is a real small business loan guaranteed to report on-time, ongoing payments through the maturity of the loan, and it will remain on the report as a positive account after the loan is closed

- This small business loan is designed to enhance the depth and strength of your business credit profile with Equifax and the Small Business Finance Exchange (SBFE)

How business credit scores are used:

Lenders and other creditors need a means of determining how well your business repays debts before they will approve you for financing. This is where business credit scores come in. Higher scores indicate to creditors that your business is more trustworthy, thereby improving the odds that you can obtain financing. Lenders can check your company’s business credit reports to get more detailed information about your business’s financial history, and business credit scores serves as shorthand evaluations. Here are three other ways your business credit scores are used:

- Determine your borrowing power: Your business credit report and score can determine how much financing you are able to secure.

- Determine your rates on business insurance: Some insurance providers evaluate a business owner’s credit as well as the business’s credit to determine rates on commercial insurance.

- Determine terms you can secure with vendors and suppliers: Vendors and suppliers sometimes look at a business’s credit scores to decide how long of a grace period to give the business before demanding payment for goods and services. These terms are express in “net” terms—” Net-30” would mean your business has 30 days to post payment. Securing longer terms on your terms with suppliers is a great way to help even out cash flow.

The importance of checking your business credit score:

As a business owner, you should review your company’s financial information on a regular basis, including your business credit scores & business credit reports. Your scores are fluid and can change over time. That’s why creditors tend to assess your creditworthiness on a continual basis. If you notice your trade credit scores are low, there could be an error in the business credit reports that caused an inaccurate calculation. It is also possible that your business does not have sufficient credit history to warrant higher scores.

If you do find an error, contacting the credit agency that generated the score is key to getting a correction. If there aren’t any errors, you can still improve your business’s credit scores by making on-time payments and lowering the company’s credit utilization ratio, among other options, but it will take some time.

Whether you’ve just started a business or been in the game for years, building a strong credit profile is essential to stay competitive.

| Business credit score | Score range | Score overview | Typically used by |

|

Dun & Bradstreet PAYDEX | 0-100 |

Signifies how promptly you’ve paid bills in the past. |

Vendors and suppliers to evaluate what trade terms to extend to your business. |

|

Intelliscore PlusSM from Experian | 0-100 |

Predicts the likelihood of serious delinquency in the next 12 months. |

Lenders to evaluate your business for loans and lines of credit. |

|

FICO® LiquidCredit® Small Business Scoring Service? | 0-300 |

Rank-orders small businesses by their likelihood of making payments on time. Personal and business credit factors may both be used. |

Banks and other lenders to evaluate your business for loans and lines of credit. Required for certain SBA loans. |

The Dun & Bradstreet PAYDEX

The PAYDEX is a unique, dollar weighted indicator of a business’s payment performance based on the total number of payment experiences in Dun & Bradstreet’s file. The Dun & Bradstreet PAYDEX ranges from 1 to 100, with higher scores indicating better payment performance. PAYDEX is primarily used by vendors and suppliers to judge your business when determining what terms to extend on trade credit (e.g., net 30, net 60, etc.) Typically, the better the score, the more generous the terms extended. This is important because having more time to pay your bills can help you better manage cash flow.

Intelliscore Plus from Experian

The Experian Intelliscore Plus is a statistically based credit-risk score that can combine business and proprietor credit data to predict the likelihood of serious delinquency in the next 12 months. Scores range from 1 to 100, where lower scores (score range below) indicate higher risk. Risk is very low in the first two risk classes, risk class 3 is average, and classes 4 and 5 present above-average risk levels. The Intelliscore Plus is regarded in the credit industry as quite predictive and economical. It incorporates statistical modeling using over 800 commercial and owner variables – including tradeline and collection information, recent credit inquiries, public filings, new account activity, key financial ratios and other performance indicators.

FICO® LiquidCredit® Small Business Scoring Service

FICO’s Small Business Scoring Service (SBSS) rank-orders applicants by their likelihood of making payments on time. The score ranges from 0 to 300. The higher the score, the better. The scoring is based upon personal and business credit history and other financial information. A strong history of business credit with timely payments to vendors and suppliers may help boost your SBSS score. The FICO SBSS score will be used for term loans, lines of credit, and commercial loans up to $350,000 from the Small Business Administration (SBA). The minimum score to pass the SBA’s pre-screen process is currently 140.

844-526-1261

.png)